Product Strategy & Commercialization

There are so many things that need to come together for a new product to succeed. Our Product Strategy & Commercialization practice has broken down the many factors and focuses on three main phases:

- Evaluating the opportunity

- Commercializing the product or offering

- Managing the product

The proper execution of these three steps has led to improving success by 300%!

The product strategy and commercialization studies provided on this page reflect our preferred methods for working on new products. These studies are based on work performed for more than 100 new products, including concepts advanced by funded-startup founders, university technology commercialization offices, and corporate innovation teams. These methods have proven useful across a range of industries.

Opportunity Triage

We encourage clients to refine their thoughts about their product creation, whether it’s based on a great idea or outstanding results from research. The Opportunity Triage spells out how to better understand the market, competition, and the customers. It is intended to be a lightweight assessment as to market need and commercial potential of the business opportunity.

This work typically uncovers promising market entry points and feature sets required to meet the needs of early adopters. We seek to identify a short list of critical assumptions to test. When resources are scarce, at these very early stages, we want to be very purposeful about where and when we spend those resources.

Commercialization

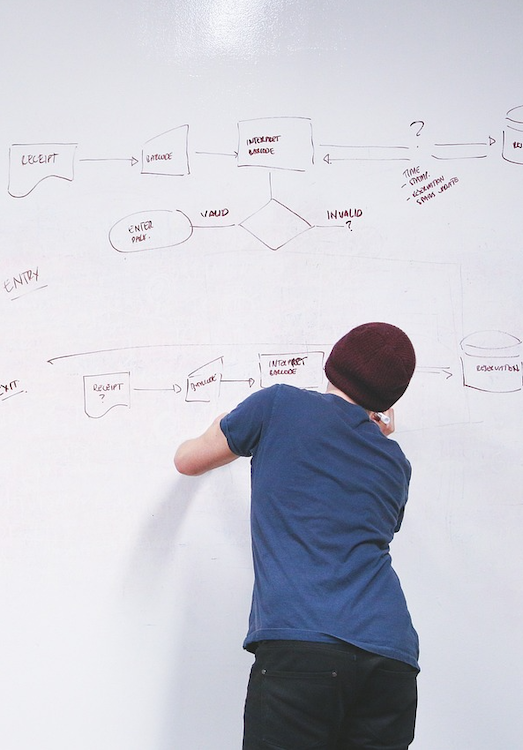

Commercialization is the process of introducing a new product into the market. It is often confused with sales, marketing, or business development. Each of which play a part, yet the entirety of commercialization is more encompassing. It’s a stage-gate funnel that helps make more informed business decisions from the very early stages of turning a concept into a market reality.

Product Management

A new product typically starts with a true MVP (minimum viable product), and not adding a ton of features to the first version. We encourage a stepwise approach – the “build-measure-learn” process advocated in The Lean Startup (Ries, 2011) and the NSF’s I-Corps program. In our experience, we find end-users engage with a product differently than anticipated and seen in testing. Keeping scope focused allows for efficient testing of hypotheses, and running tests in market with real customers.

- We optimize use of resources, building only what is required, when it is required focusing on the highest ROI items (lowest level of effort, highest return).

- We let actual user experience, in the field, guide further iterations, ensuring we don’t build what users don’t want and the business won’t value.

- We can get new versions in end-user’s hands faster, allowing them to realize the benefits of using the product earlier.

From there, ensuring the product survives is an orchestration of all the activities, and product development initiatives required to run a business. Taivara’s eBook The Art of Mindful Product Management summarizes our findings of practices required for early-stage products.

Kevin Dwinnell

VP, Product Strategy & Commercialization

Kevin, head of product strategy and commercialization for Taivara, has a history of driving product innovation and testing new business markets to boost top-line revenue. With more than 20 years in the startup and technology space, he has performed work for leading institutions like Bread Financial, DARPA, In-Q-Tel, InterDigital and more. He’s also works with early-stage technologies from university technology commercialization offices and venture-funded startups. He leverages a lean process to improve chances for success.

During his tenure, he has come to recognize some recurring themes in various industries. Those themes are:

- Fintech – reduce transaction fees for business clients, and keep the consumer experience frictionless.

- Mobile health – state and federal regulations increase product complexity. Upside for tracking, monitoring, and reporting. Fragmented market offers opportunity amongst the noise.

- Smart cities – solutions need a clear return on investment to justify expense, the pressure to open-source the data creates a conflict of interest in public/private partnerships.

- Industrial Internet of things (IIoT) – an emerging market with vertical integrators gaining traction, slow platform adoption makes point solutions difficult to sell.

- Cybersecurity – overworked teams; products need to prevent or fix problems, not identify more.

- Retail tech – slow hardware upgrade cycles struggle to keep up with security needs and rapidly changing shopper expectations.

Follow Kevin on Linkedin for more on Product Strategy & Commercialization!